2025 housing market kicks off with good balance of inventory and stable pricing

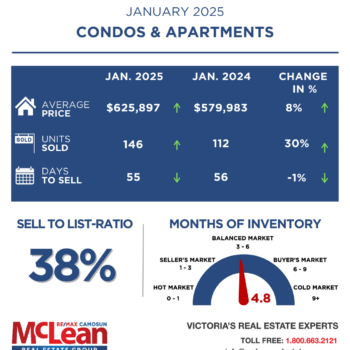

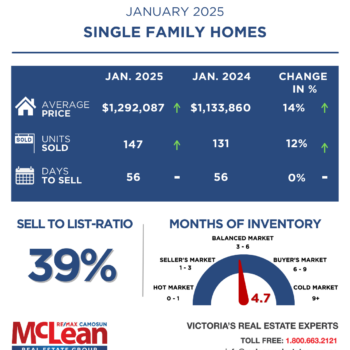

February 3, 2025 A total of 422 properties sold in the Victoria Real Estate Board region this January, 23.8 per cent more than the 341 properties sold in January 2024 and 0.2 per cent more than in December 2024. Sales of condominiums were up 30.4 per cent from January 2024 with 146 units sold. Sales of single family homes increased by 19.8 per cent from January 2024 with 194 sold.

The 2025 housing market is off to a strong start, with balanced inventory and stable pricing setting the stage for the months ahead. January saw a significant increase in new listings—over 1,000 properties were added to the market for the first time in a decade. This boost in inventory is a positive sign for buyers and sellers alike, as we enter the new year with strong momentum.

Market fundamentals remain solid. Pricing is steady, inventory levels are favorable compared to recent years, and interest rates continue trending in a positive direction for consumers. However, global trade uncertainties may introduce shifts in the market, and we are closely monitoring potential impacts.

As of January 30, 2025, Canada’s prime rate stands at 5.20%. The Bank of Canada has made its sixth consecutive rate cut, lowering its benchmark rate to 3%. This decision comes as inflation drops to 1.8%, aided by a temporary GST break from the federal government. The economic landscape remains dynamic, with concerns surrounding potential tariffs from the U.S. creating uncertainty for Canadian markets.

Staying informed is key in this evolving real estate climate. For expert insights and the latest updates on the Victoria market, sign up for our Victoria Real Estate Insider! Email us at team@mcleanrealestategroup.ca or sign up here: https://www.mcleanrealestategroup.ca/contact/.